Demystifying Taxation For Solopreneurs, Freelancers, Gig Workers, and MSMEs

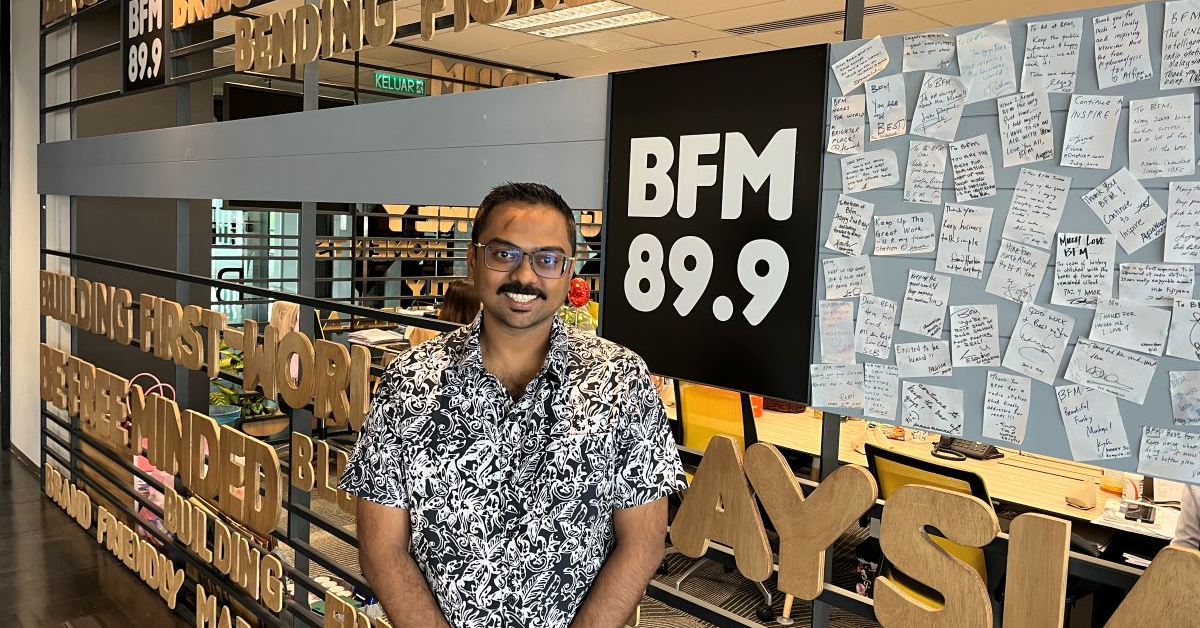

Thenesh Kannaa, Partner and Tax Advisor, TraTax

19-Apr-23 12:00

Embed Podcast

You can share this podcast by copying this HTML to your clipboard and pasting into your blog or web page.

Close

While taxation for employed individuals is relatively straightforward, that can’t be said for those who are self-employed, in the gig economy, or running a sole prop or SME, who don’t have EA forms and have various income streams to declare.

So today on BizBytes, we attempt to help demystify the wide and complicated world of taxation for self-employed folks, MSMEs, and SMEs. We explore how taxation differs for business income; be it MSMEs, freelancing, or gig-workers, and what you should know when it comes to filling, tax deductions, address common mistakes,and how to optimize the next tax season.

Helping us with this conversation is Thenesh Kannaa, Partner and Tax Advisor for TraTax, an independent tax advisory firm.

Produced by: Roshan Kanesan

Presented by: Roshan Kanesan

This and more than 60,000 other podcasts in your hand. Download the all new BFM mobile app.

Categories: markets, economy, Corporates, government, entrepreneurs, SME, financial wellness

Tags: tax regulation, msme, taxes, tax exemption, finance, freelancers, gig-workers, lhdn,