Retroactive Revisions To Service Tax: Understanding Changes For The Logistics Sector

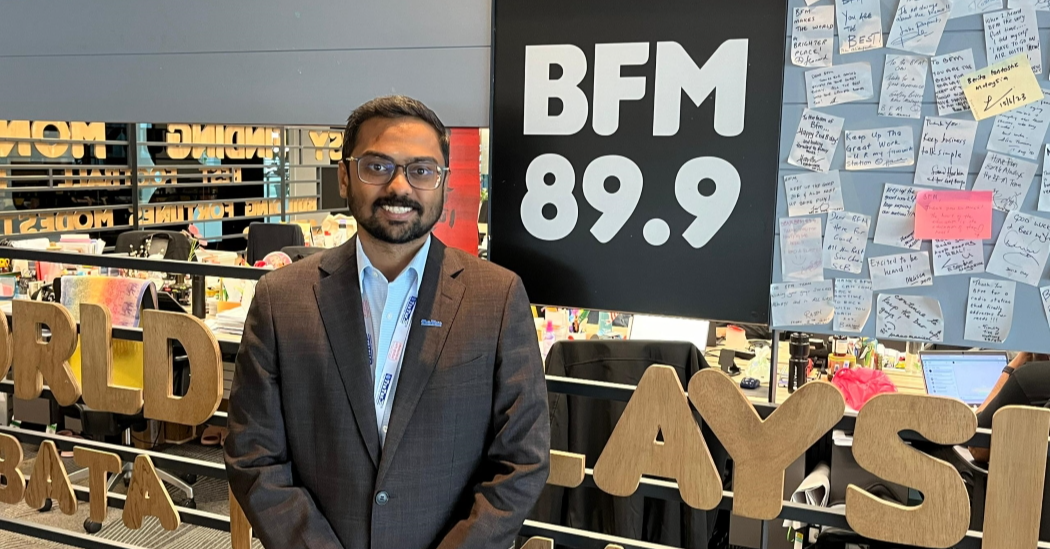

Thenesh Kannaa, Executive Director, Tratax

02-Sep-24 12:00

Embed Podcast

You can share this podcast by copying this HTML to your clipboard and pasting into your blog or web page.

Close

In this episode of Enterprise Explores, we dive into the latest revisions to the Service Tax Policy for the logistics sector, introduced by the Royal Malaysian Customs Department. These changes, effective retrospectively from 1st March 2024, are set to have significant implications not only for businesses within the logistics industry but also for those that rely heavily on these services.

To help us navigate these revisions, I’m joined by Thenesh Kannaa, Executive Director of Tratax, who unpacks the key changes and explores their impact on businesses. We also touch on other important updates to the Service Tax regime, identify areas where further clarification might still be needed, and touch on the difference between GST and SST.

Produced by: Roshan Kanesan

Presented by: Roshan Kanesan

This and more than 60,000 other podcasts in your hand. Download the all new BFM mobile app.

Categories: economy, government, financial wellness

Tags: tax revisions, GST & SST, logistics industry,