3 Finance Mistakes That Could Derail Your Early-Stage Startup

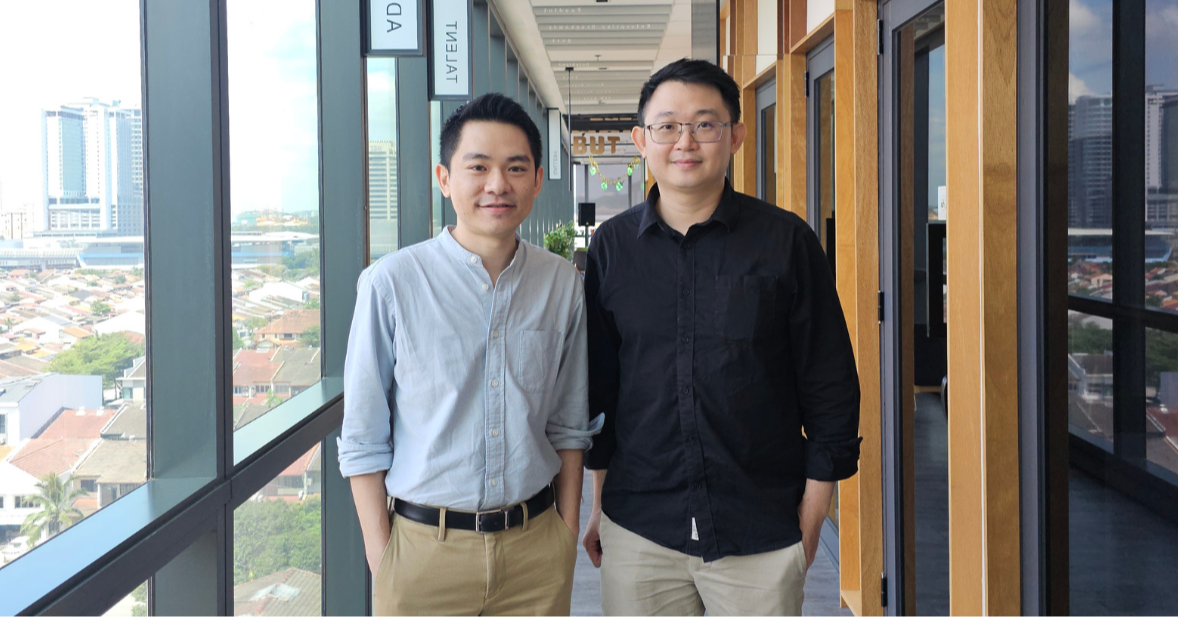

Chan Qi Yang, Co-Founder, FinKnight | Chang Lih Yen, Co-Founder, FinKnight

14-Apr-25 11:00

Embed Podcast

You can share this podcast by copying this HTML to your clipboard and pasting into your blog or web page.

Close

Startups live and die by their numbers, but too many founders treat finance as an afterthought. In this episode of P&L, we lay the groundwork for better financial management with Chan Qi Yang and Chang Lih Yen, Co-Founders of FinKnight, a financial advisory firm that helps startups get their numbers right from the very beginning.

We explore what it takes to build a strong finance function from day one: the three core financial statements every founder must master (cash flow, P&L, and balance sheet), how to avoid common pitfalls like poor revenue recognition and ignoring inventory, and why accurate bookkeeping is just the beginning.

Plus, they share how to balance lean operations with growing compliance needs, when to start hiring for finance roles, and how to create flexible, forward-looking budgets that actually guide decision-making.

Whether you're bootstrapping or prepping for a Series A, this episode is your crash course on startup finance done right, and why clean books aren’t just for auditors, but for growth, strategy, and fundraising too.

Produced by: Roshan Kanesan

Presented by: Roshan Kanesan

This and more than 60,000 other podcasts in your hand. Download the all new BFM mobile app.

Categories: Corporates, managing, entrepreneurs, SME, financial wellness

Tags: startup finance, cash flow, fundraising, bookkeeping, early-stage startups,