VC Math Demystified: What Founders Must Know Today

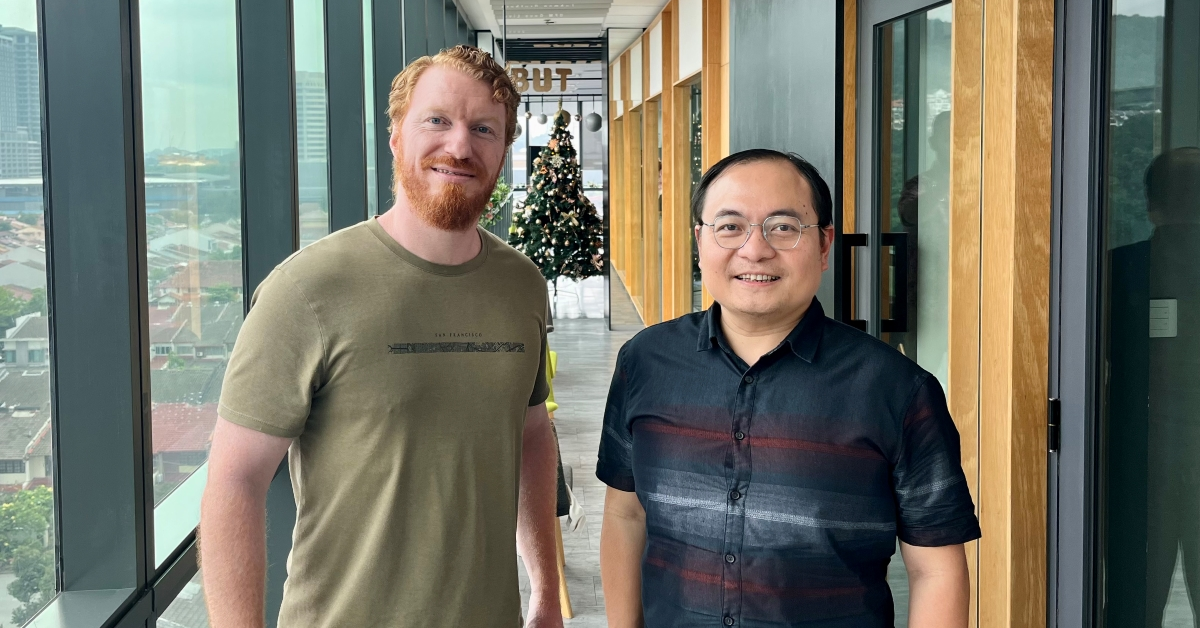

Kevin Brockland, Managing Partner, Indelible Ventures | Yeoh Chen Chow, Founder, 1% Advisory & Coaching

09-Dec-24 11:00

Embed Podcast

You can share this podcast by copying this HTML to your clipboard and pasting into your blog or web page.

Close

Pitching to VCs? Understand their math and incentives first.

Venture capital is more than just funding—it’s a high-stakes game of expectations. In this episode of P&L, Kevin Brockland, Managing Partner of Indelible Ventures, and Yeoh Chen Chow, Founder of 1% Advisory & Coaching, break down VC math and incentive structures and why it's vital for founders to understand all this.

From the 2/20 model and failure rates to aligning with a VC’s growth expectations, we explore why “fundraising is not a trophy” but a responsibility. Plus, learn how to choose the right investor, pitch your business as an opportunity, and navigate post-investment dynamics effectively.

Here are some key highlights from the conversation:

- VC Math Fundamentals: A breakdown of the 2/20 model, high failure rates, and the need for outsized returns. Explore how these calculations shape VC strategies and expectations for startups.

- Why Founders Should Care: Understand the importance of aligning your business model with VC expectations and why “fundraising is not a trophy but a responsibility.”

- Misconceptions About Venture Capital: Debunk myths like VCs being inherently wealthy and uncover the challenges of managing funds and delivering returns.

- Choosing the Right VC: Discover the value of chemistry and alignment in the founder-investor relationship, along with tips on finding a VC who aligns with your vision and stage.

- Positioning Your Pitch: Learn how to frame your business as an opportunity rather than a plea for funding, while balancing ambition, scalability, and realistic goals.

- Post-Investment Dynamics: Highlight the role of transparency and trust in the founder-VC relationship. Understand how VCs can contribute beyond funding through operational guidance and strategic insights.

Produced by: Roshan Kanesan

Presented by: Roshan Kanesan

This and more than 60,000 other podcasts in your hand. Download the all new BFM mobile app.

Categories: markets, Corporates, financial wellness, investments

Tags: vc math, vc, venture capital, fundraising,